How do I turn off VAT for foreign receipts?

Table of Contents

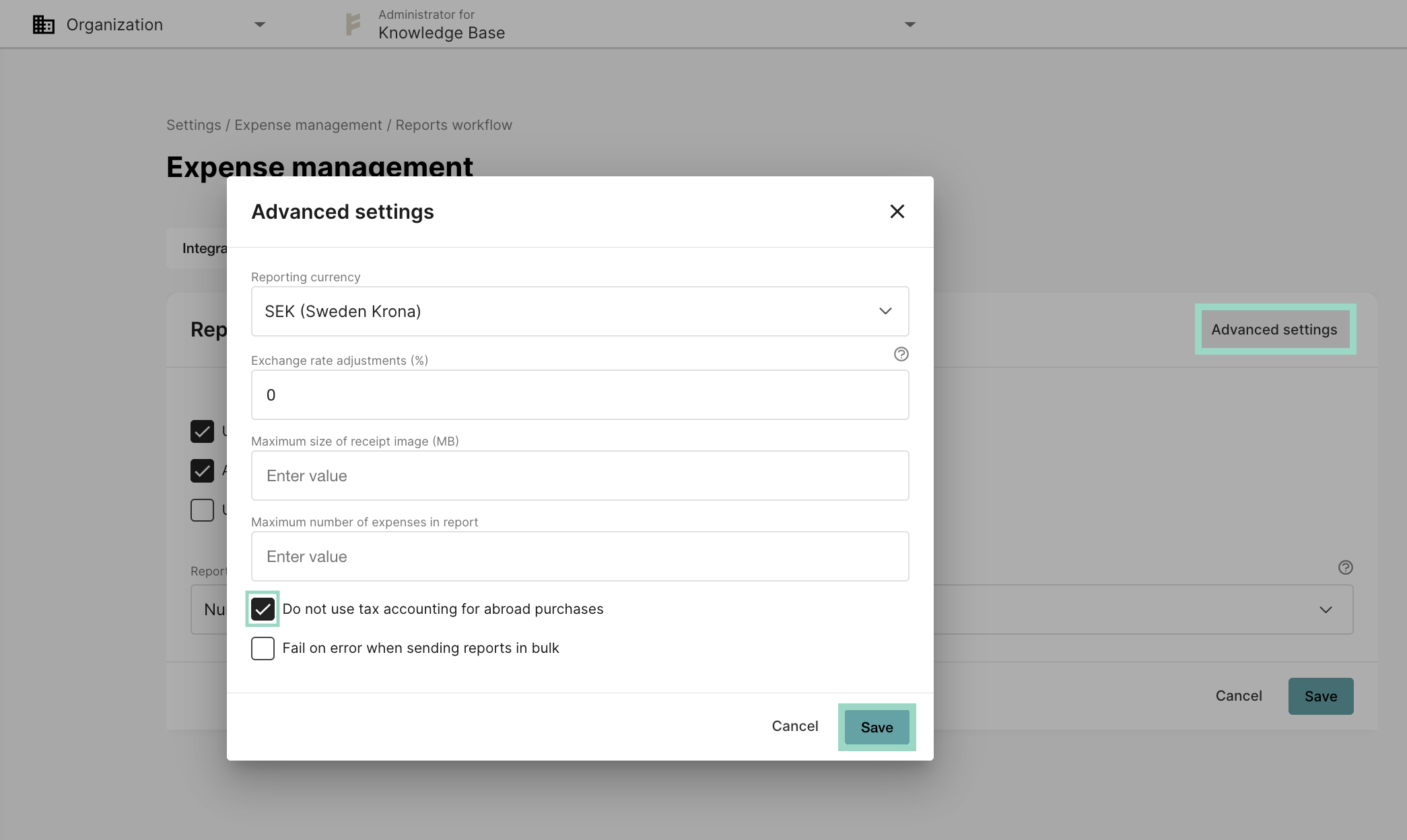

On organisation level, go to Settings > Expense management > Reports workflow. Click on Advanced settings. A new box will open and here you tick the box for Do not use tax accounting for abroad purchases. Save the settings.

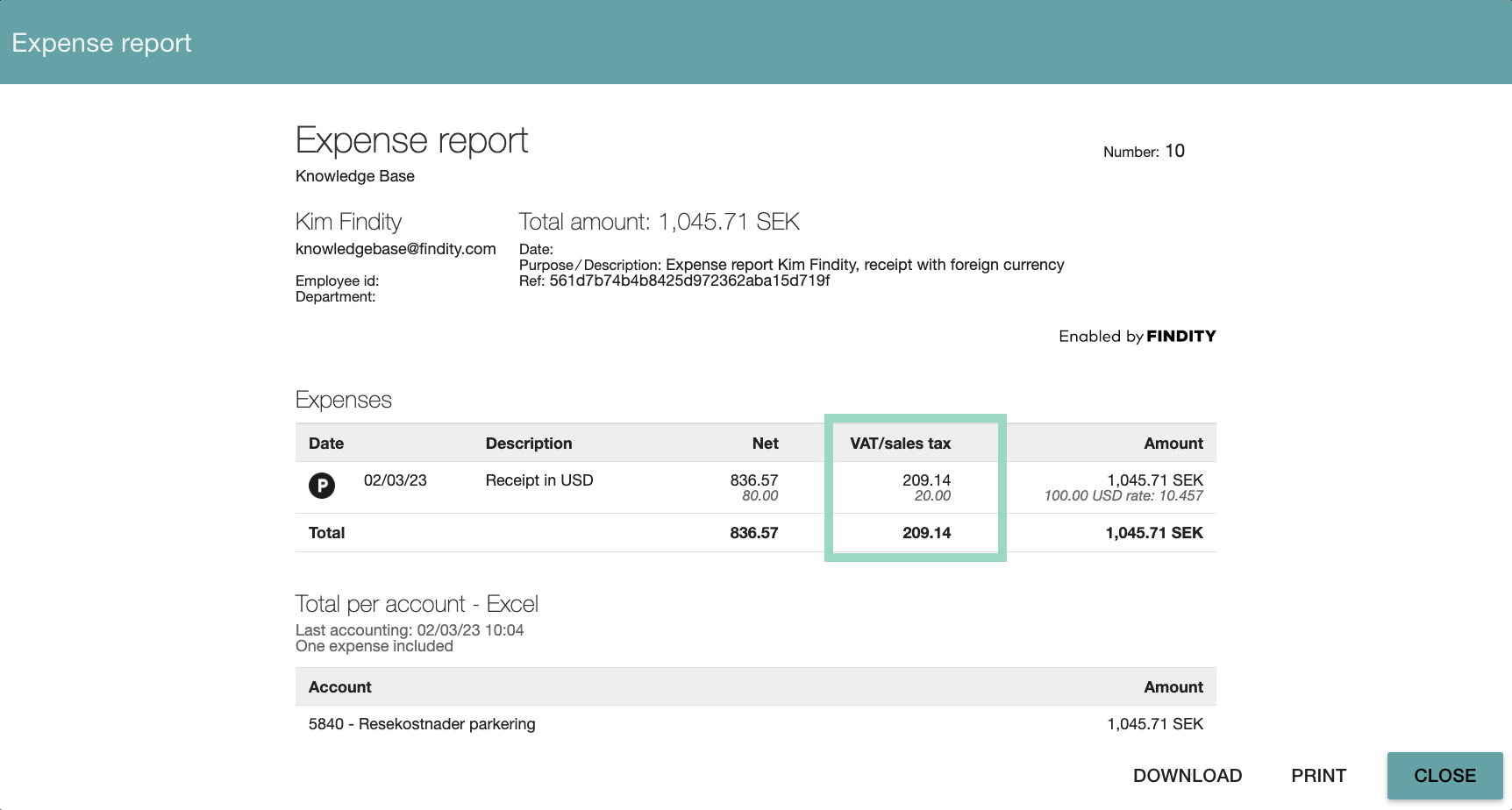

Now when a user submits a receipt with a foreign currency (any other currency than the chosen reporting currency) no VAT will be registered in the accounting. Please note that the VAT will be shown on the user's expense (if they have added a VAT amount) but if you check the accounting, you can see that the VAT isn't registered. See an example here below.

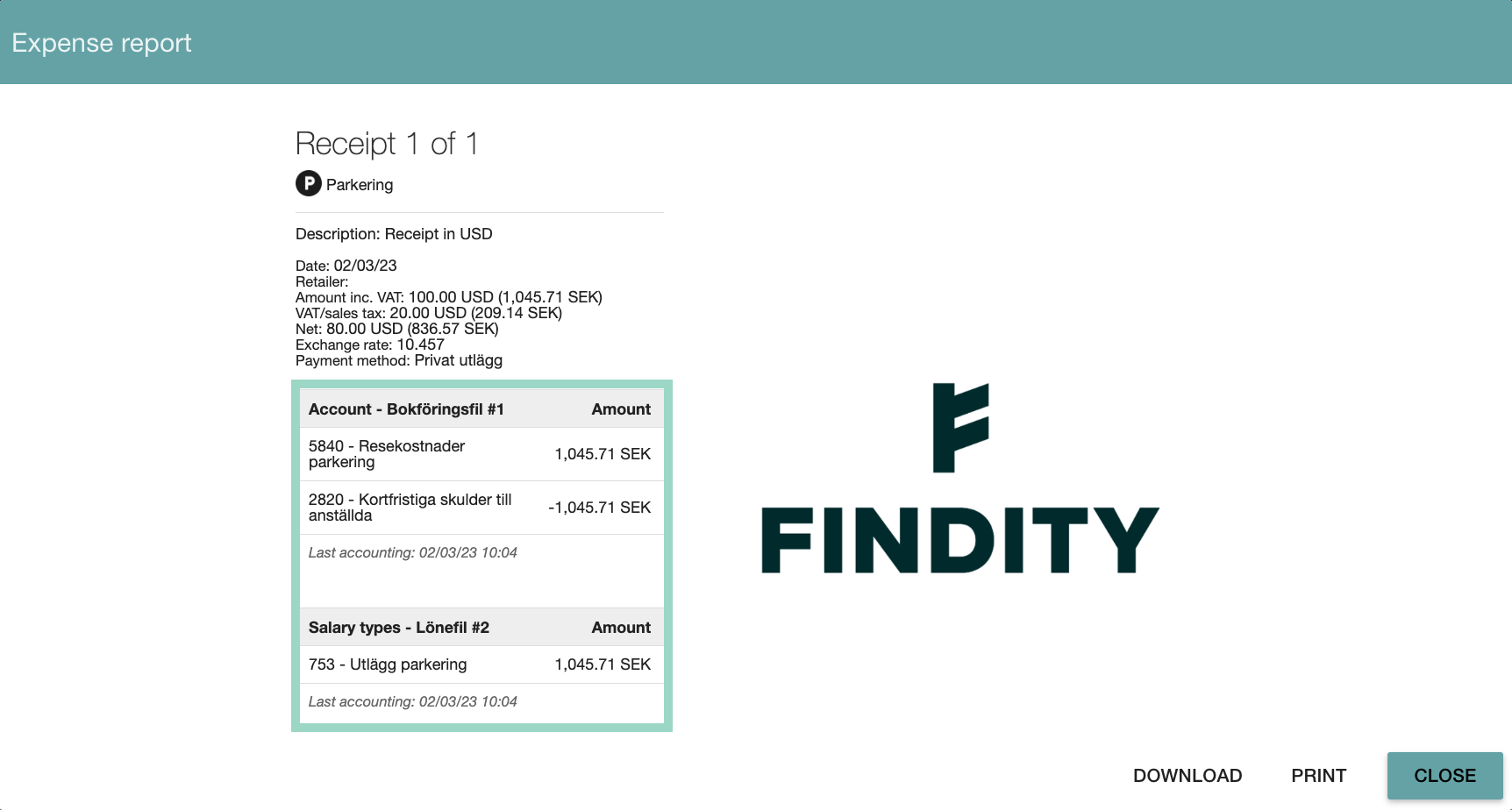

Here is an example where a user has added a receipt in USD and also added the tax/VAT in the expense.

Since we have activated "Do not use tax accounting for abroad purchases" the tax will not be registered in the accounting. As you see here below in the accounting, there's no VAT/tax booked: