How do we add a deductible part of VAT for example rental car?

Table of Contents

This article applies to the following countries

- All countries

Add the settings

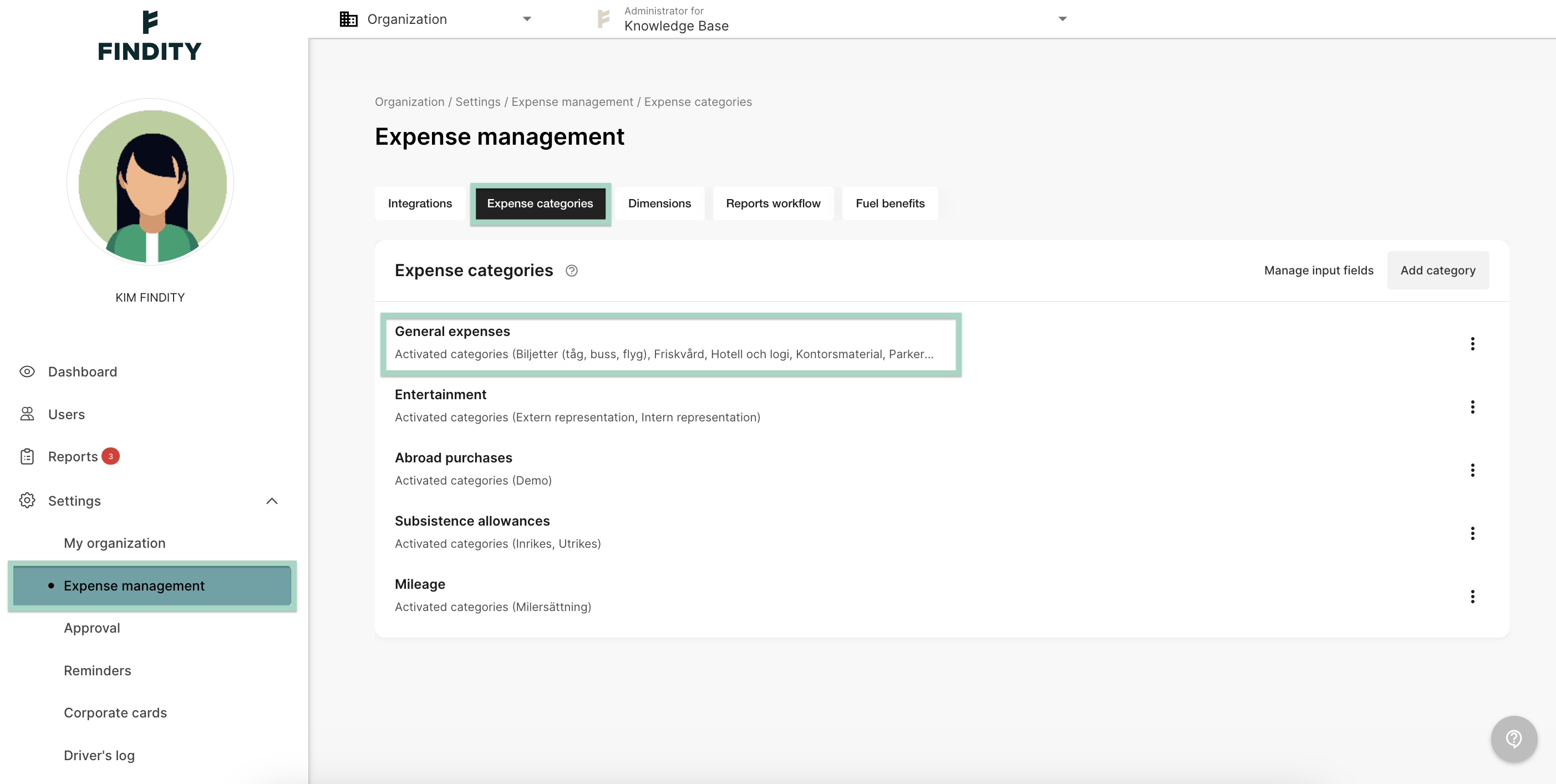

Go to the tab Settings - Expense management - Expense categories - General expenses.

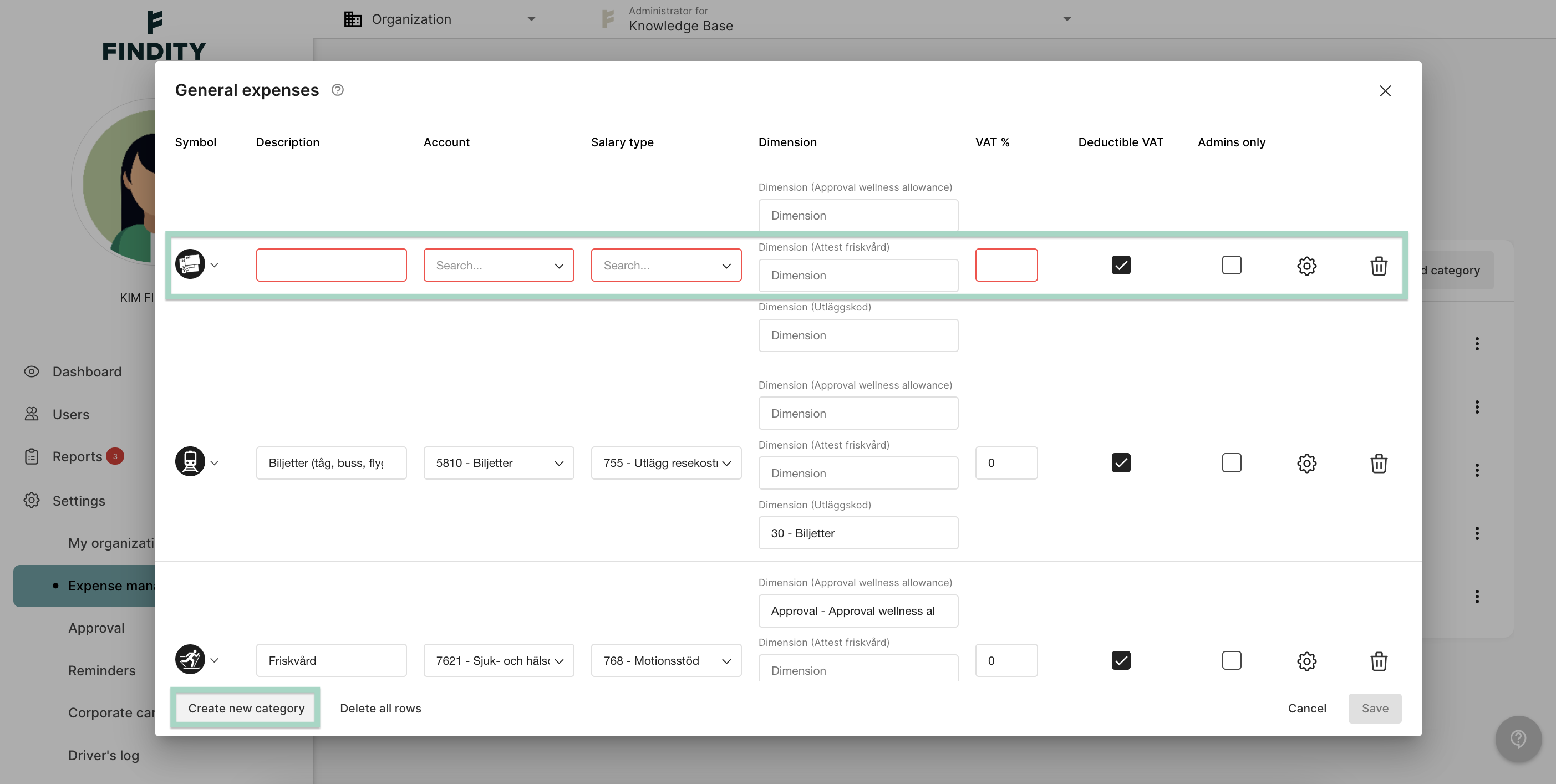

Choose to Create new category and fill in the information in the line.

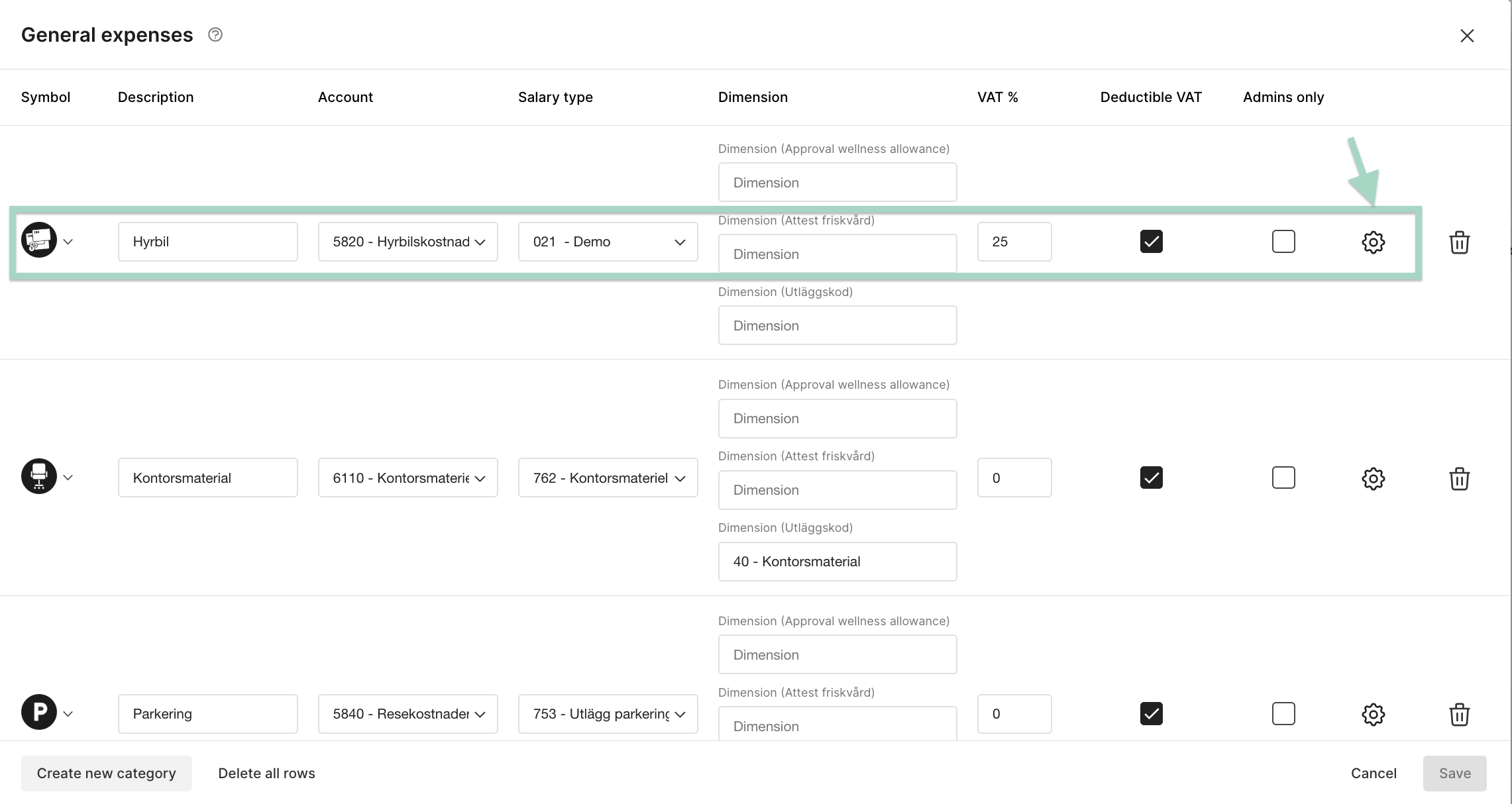

In this example we have added a category for Rental car.

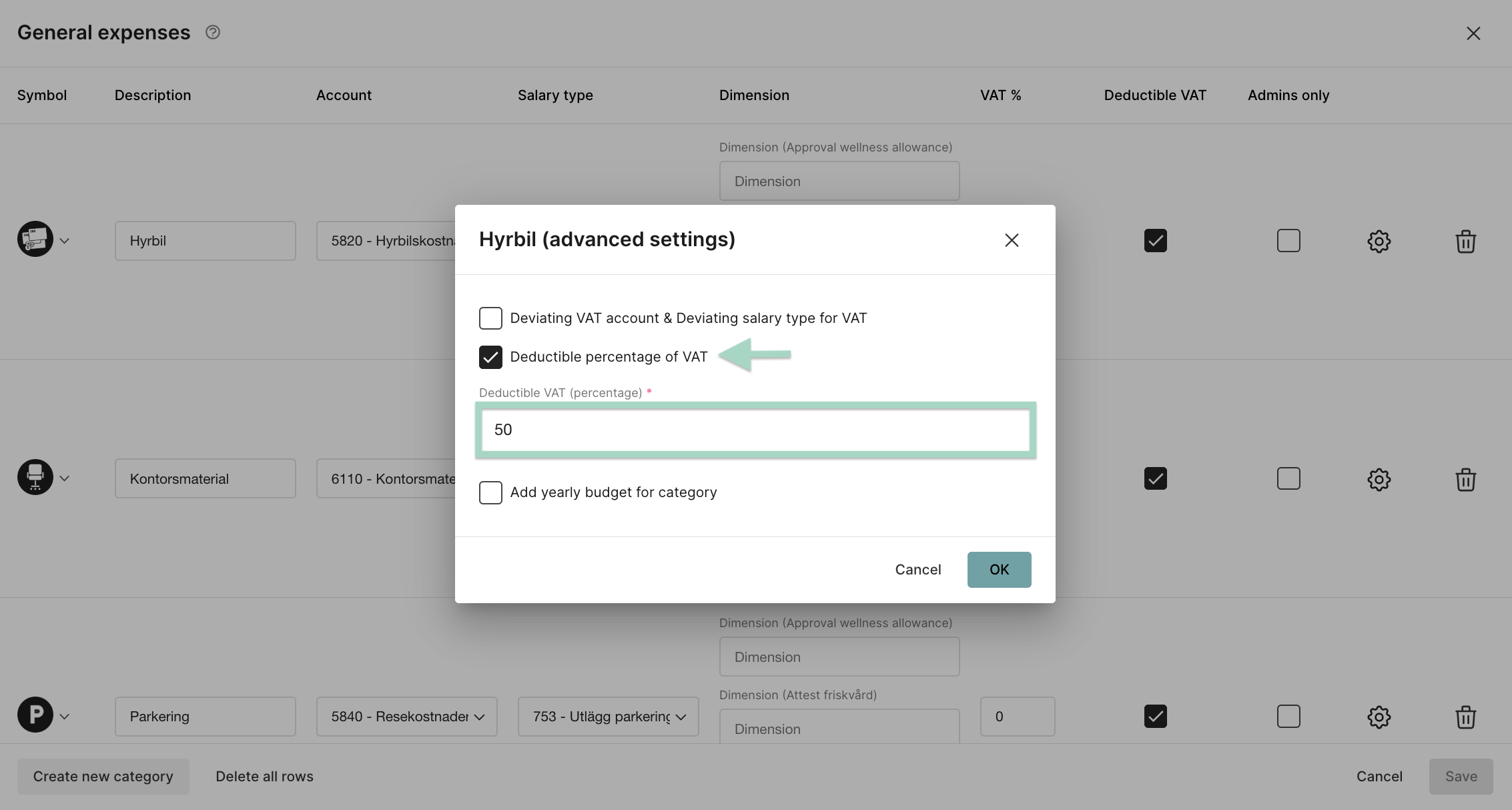

Click on the cogwheel on the category.

Mark the box next to Deducible percentage of VAT and add the percentage VAT. In this example have we added 50% in the setting for deductible VAT percentage.

Press OK when you are done with the settings.

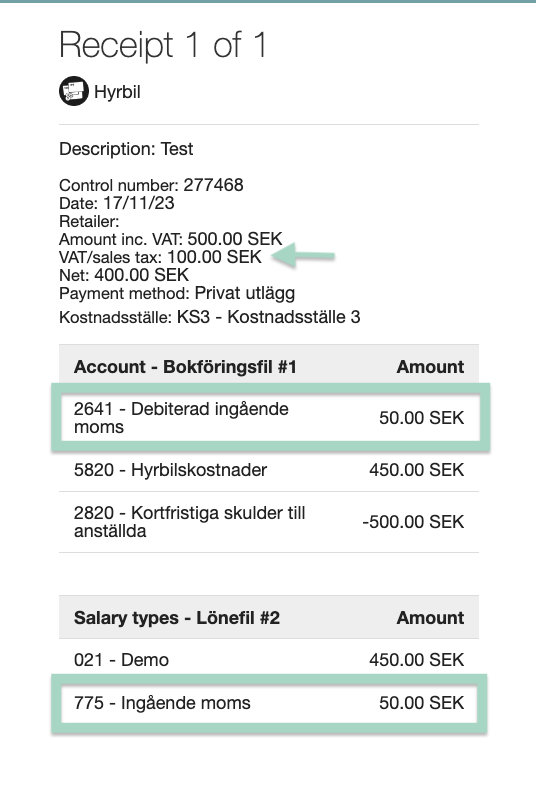

Accounting in the users report

When the user create a report with the category rental car, VAT in the accounting will only be added with 50% of the total amount of VAT. In this example the user has added 100 SEK in VAT. The accounting in the report is 50 SEK VAT according to the setting we made.